The 6 Best Ways to Make a Great Impression in Your Interview

Learn essential tips to make a great impression in your interview. Master attire, engage with confidence, and follow up strategically.

Making a Career Change: 4 Things to Think About

Discover steps to embark on a new career path successfully. From self-reflection to skill assessment, learn how to navigate a fulfilling transition.

From Average to Exceptional: Why Furthering Your Education Is Important

Discover the lifelong benefits of furthering your education, from staying relevant in evolving industries to unlocking new career opportunities.

Ways To Make Your School a Better Place for Learning

Your school should make learning easy, and you must make some changes to help with this. Here’s how you can make your school a better place for learning.

3 Tips for a Successful Senior Year of High School

Your final year of high school is both an exciting and nerve-racking period in your life. Check out these tips for a successful senior year of high school.

Predictive Index Tests Are Better Than Traditional Hiring Tests

Improve hiring with Predictive Index tests assessing core traits. Streamline applications, reduce turnover, and make informed decisions.

How to Choose the Right University: 10 Important Criteria

Discover essential criteria and insights on how to choose a university. Explore factors like academic programs, campus facilities, financial aid, and personal preferences to make an informed decision for your higher education journey.

Top 8 College Application Mistakes to Avoid

Avoid common college application mistakes and master the admission process with expert tips. Maximize your chances of securing a spot at your dream school.

How You Can Find Wisdom in Daily Inspirational Messages

Explore the transformative power of daily inspirational messages in CosmoBC's quotes repository. Discover how these nuggets of wisdom offer instant motivation, courage, and guidance, shaping a fulfilling life through their transformative influence.

Tips to Write a Plagiarism Free Research Paper

Learn the nuances of writing a plagiarism-free research paper: types of plagiarism, research tips, citation importance, and enhancing content with media for academic integrity.

Tips for Choosing a Career Path That Suits Your Needs

Navigate the path to a fulfilling career with these essential tips. From identifying strengths to researching industries, make informed choices for professional success.

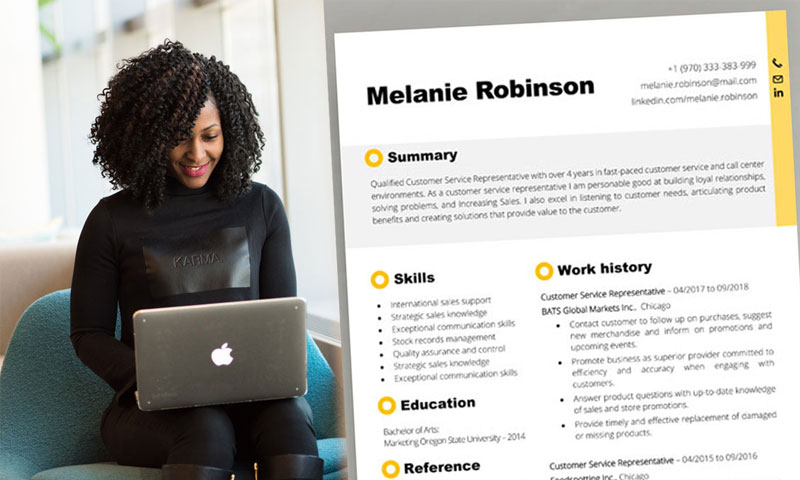

Recipe for a Strong Resume – How to Make an Impression?

A strong resume is crucial, if you want to show your qualifications, experience and other skills to your potential employer. Obviously, as a result it will also prove helpful to land the job of your dreams. How to prepare a resume which will impress everyone?